By Ronan McMahon

When you look everywhere, you’ll always find opportunity somewhere.

That’s the beauty of being an international real estate scout, and something I learned years ago when I first started out on my overseas adventures.

That’s why I spend so much time on the road. It’s why my team and I spend over $1 million a year on travel and research.

Because there’s no magic trick to finding profitable real estate opportunities…

It takes resources, it takes a network of contacts, and it takes vast amounts of boots-on-the-ground research.

My team and I do it all so you don’t have to…

And this special report—The Best Places in the World to Buy Real Estate in 2024—is designed to be the perfect place for you to start your research.

This is my ultimate rundown of the destinations where I’ve identified the strongest potential for profit and lifestyle benefits through real estate in the coming year.

From the Caribbean coast of Mexico to booming “second cities” in France to the historic seaside towns of Portugal, my team and I have dug deep to find places where savvy real estate investors like us can unlock untold opportunities in the next 12 months and beyond.

In 2024, this research has never been more important…

The past year has seen a “new normal” emerge, and it’s taking shape in an era of war, shortages, uncertainty and inflation…

We are now experiencing a fundamental global turning point. A point at which an emerging scarcity of certain base commodities, ranging from oil and gas to rare earth metals and even food, threatens to push up the price of everything, from used cars to new homes.

Materials and labor shortages, combined with inflation and bureaucratic backlogs, have constricted the supply of real estate and driven up the costs like never before.

In the U.S. the median home sales price was $417,700 as of the fourth quarter of 2023. That’s a 37% increase from the first quarter of 2020, when the median was $329,000. And the median price is much higher depending on where you look. In California for instance its around $800,000.

That’s what happens when high demand meets scarcity head on. Prices rise right to the precipice of affordability—and often spill over.

But when we buy best-in-class real estate in the right destination overseas, we can benefit from the same scarcity and demand, but at prices that haven’t become unaffordable.

This means there is a lot more room for growth. And with huge numbers of people now working remotely and traveling overseas—with millions more only contemplating it for the first time—demand is set to continue to grow for years to come.

That’s why it’s smart to look for the right deal in the right destinations.

Buying at a low price is step one to locking in incredible yield potential. Buying something with huge appreciation potential is key to your exit strategy.

For me this is the perfect path to freedom, both financial and personal. The freedom to go where you want, when you want. Freedom from worry and stress…from caring what happens in the stock market…or what’s happening in the 24-hour news cycle…

And whether you’re a complete beginner or an investor with some real estate experience under your belt, finding the right place to buy is the first step in what could be a life-changing journey.

It’s also an opportunity to re-examine your lifestyle and think about how and where you want to live. Myself, I use my real estate overseas to ensure that I live a life of comfort, where I never need to worry about heating or air conditioning. Where winter is a thing of the past and excellent golf is always nearby.

That’s why, in this report on The Best Places in the World to Buy Real Estate in 2024, I’ve included two types of “real estate play.”

The “investment play” is a pure profit play, where I believe you can earn capital appreciation and/or strong rental yields on the right real estate.

The “lifestyle play” is one where a real estate buy can land you an enviable lifestyle of beautiful weather, leisure, and luxury for incredible value—even if it doesn’t deliver strong returns.

Of course, I always strive to find the best real estate plays around, and so you’ll see that many places on this list have both: an investment and a lifestyle play. These are my gold-star locations, and the ones where I consistently find the best deals in terms of profit and pleasure.

Read on for my list of best places to buy in 2024…

Wishing you good real estate investing,

Ronan McMahon

What Makes a Place Good for

Real Estate Investing?

When you google the best places in the world to buy real estate, more often than not you’ll get a generic and entirely predictable list of the world’s most expensive destinations.

Think New York…Tokyo…Paris…London…

Not only are these lists uninformative, I believe they are wholly inaccurate.

Prices for best-in-class real estate in global cities like London and New York are often enormous. And that’s before you consider the massive holding costs due to things like high property taxes and homeowners association fees.

Moreover, because these are highly developed markets, the potential to generate rapid capital appreciation and strong rental yields is typically limited.

In other words, most “best of” lists equate best with most expensive…and therefore fail to answer the question.

So, before we go any further, let me explain how I compiled my list and what I mean by “best”…

To select the best destinations in the world to buy real estate for 2024, I considered places that excel in one or more of the following categories:

- Relative Value—This means “bang for your buck” and refers to places that offer excellent value for money. Consider, for instance, that there are stunning destinations around the world where you can get expansive villas with swimming pools and ocean views for less than the cost of a dated two-bed condo in London or San Francisco.

- Capital Appreciation—This refers to destinations that are developing rapidly and as such have the potential to deliver a strong return on your investment over time, if your buy the right real estate.

- Rental Income—This is how much you can expect to earn from renting out a property short or long term, relative to the amount invested.

- Excellent Weather and Lifestyles—This means destinations that are highly desirable and internationalized, with outstanding infrastructure and attractions like airports, beaches, mountains, golf courses, fine dining, shopping malls, etc. They also have excellent weather. While I recognize that good weather is a subjective thing, I’m talking here about destinations that offer a warm, pleasant climate for most of the year…the kind of places where you rarely need heating or air conditioning.

I’ve applied these criteria to destinations across my global beat.

My goal: To identify places where you’ll find excellent value and incredible weather and attractions…yet can still earn a lot of money from owning there, in terms of rapid capital appreciation, strong rental income, or both.

The Best Places to

Buy Real Estate in 2024

#1: Los Cabos,

Baja California Sur, Mexico

Cabo is a boom town of 350,000 people. Its shore is lined with luxury resorts and residential communities.

In Cabo, you’ll find shopping malls, smart boutiques, art galleries, gourmet markets, high-end restaurants, world-class marinas, championship golf courses, top-notch medical care…and good infrastructure connecting it all, as well as an international airport that has expanded several times over the years to accommodate increasing visitor numbers.

It’s thoroughly modern…a place where you can get every comfort and convenience.

Cabo has long been an upscale destination and favorite vacation spot for Hollywood stars and the elite.

More recently, however, it has evolved to also attract what I call the “ordinary rich”…executives and entrepreneurs with work-from-anywhere jobs, wealthy retirees in search of perfect weather, and professionals working in the booming service sector.

I spend time in Cabo every winter. I own six properties here. I live and breathe this real estate market like almost no other, and I’ve observed firsthand as Cabo has hit a whole new level.

Demand has outstripped supply at an incredible rate. There are all sorts of restrictions on building in Cabo, yet people just keep coming.

Today, luxury two-bed condos easily rent long-term and hassle-free for $3,500 per month and up. The short-term rentals market is also incredibly strong, given the constant influx of high-end tourists.

Combine all these factors and Cabo excels in every area I outlined above, from relative value and capital appreciation to rental income and excellent weather and lifestyles.

That said, the window of opportunity to find value here is closing fast. Amid the property supply crunch, real estate prices are skyrocketing. The average sales price of a Cabo condo in the fourth quarter of 2023 was $673,184, according to brokers using MLS data.

I figure the sweet spot for investing in luxury condos in Cabo is from $400,000 to $600,000, but quality resales in this range are increasingly thin on the ground.

I have a club of like-minded investors called Real Estate Trend Alert (RETA) and I specialize in finding exclusive, off-market deals for our members. More on that group at the end of this report. Plus, how you can join. But first, I’ll give you an example of the kind of deals we get…

By leveraging RETA’s group buying power, I’ve been able to bring our members numerous opportunities in Cabo. For instance, we had our Cabo Costa deal in August 2021. RETA members could get a penthouse in this community for $249,000. I got one… As I write, a penthouse in Cabo Costa lists for $499,000—that’s $250,000 more.

But even with our insider connections, opportunities like these are becoming hard to find. That’s why I’d recommend that any investor interested in Cabo act sooner rather than later.

I’d also advise interested buyers to look at other emerging markets in Baja California. As Cabo gets maxed out, money will flow into other parts of the peninsula such as Loreto and La Paz, both places I’ve been scouting and am keeping a close eye on.

#2: Caminha, Portugal

The difference between the number one and number two spots on our list couldn’t be starker…

While Cabo is a world-famous haven of the rich and famous, Caminha is virtually unknown, even among the millions of European vacationers who flock to Portugal each year. Yet this small, charming town in the far north of the country has incredible potential and offers the best value real estate you’ll find anywhere on the Portuguese coast.

Caminha is about an hour’s drive north of Portugal’s second city, Porto, and is separated from Spain by only a river. It has a beautiful Old Town surrounded by verdant countryside on one side and stunning Atlantic beaches on the other.

Looking at real estate listings here feels like stepping into a time machine, as if the global real estate boom of the last several years never happened.

When I scouted Caminha in 2023, I found a four-bedroom condo at the center of town with unobstructed views of the Minho River listing for just €140,000. Or for €395,000 there was a large 300-square-meter house overlooking the river and Spain.

Then there were the real jewels of Caminha, grand villas built from colonial wealth. All around town I saw shells of these buildings sitting empty, waiting for someone to bring them back to life.

In the post-COVID era, Caminha is exactly the kind of place people have been flocking to…a destination with plenty of space, where you can live a relaxing outdoor lifestyle.

I predict Caminha is on the cusp of a boom. If Portugal interests you then this is a place you should pay serious attention to. The wealthier visitors and second-home owners from Northern Europe and North America aren’t coming yet, but I believe they will…and when they do they’ll drive prices higher.

Where Shall I Send Your FREE Book?

I have 500 copies of my bestselling book to giveaway today (just pay $5.97 for shipping). First come, first served.

It’s called Ronan McMahon’s Big Book of Profitable Real Estate Investing and if you’re enjoying this special report, you’ll find my book eye-opening and informative.

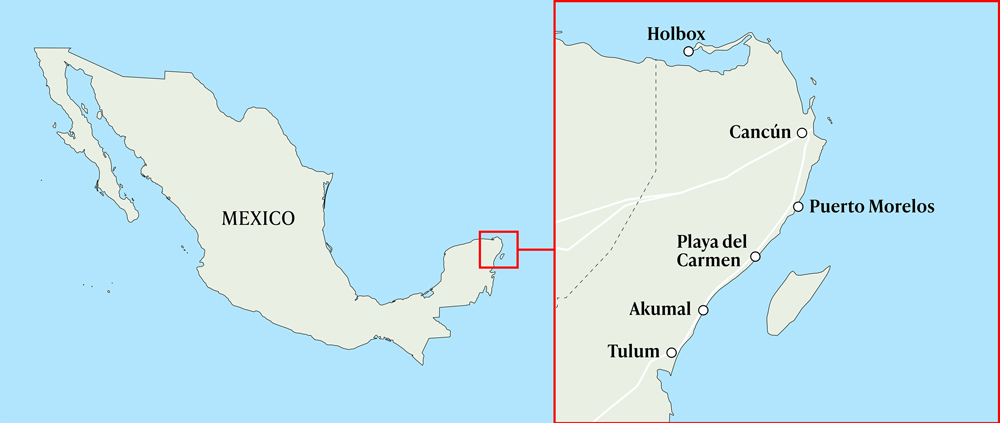

#3 (Tied): Riviera Maya, Mexico

For two decades I’ve been scouting the Riviera Maya, and for another four decades before that it’s been undergoing a mammoth transformation, the likes of which I’ve only seen surpassed by Asian mega-cities and oil-rich Middle Eastern metropolises.

The Riviera Maya refers to the 80-mile stretch of Caribbean coast in the northeast of Mexico’s Yucatán Peninsula. This region’s massive economic boom is built on one of the biggest tourism industries in the world. In 2023, close to 40 million people passed through Cancun airport. This is a record-shattering number, up nearly 10 million on the year before.

This economic juggernaut has its origins in the smart thinking and deep pockets of Mexico’s tourism investment authority, FONATUR. Back in the late 1960s, it scoured Mexico for the perfect location into which to pour funds and roll out major tourism infrastructure.

Officials settled on Cancun, where they built an international airport, began major highways, and gave incentives to major hotel groups. As Cancun grew, development pushed south along the coast…reaching first Playa del Carmen and then Tulum.

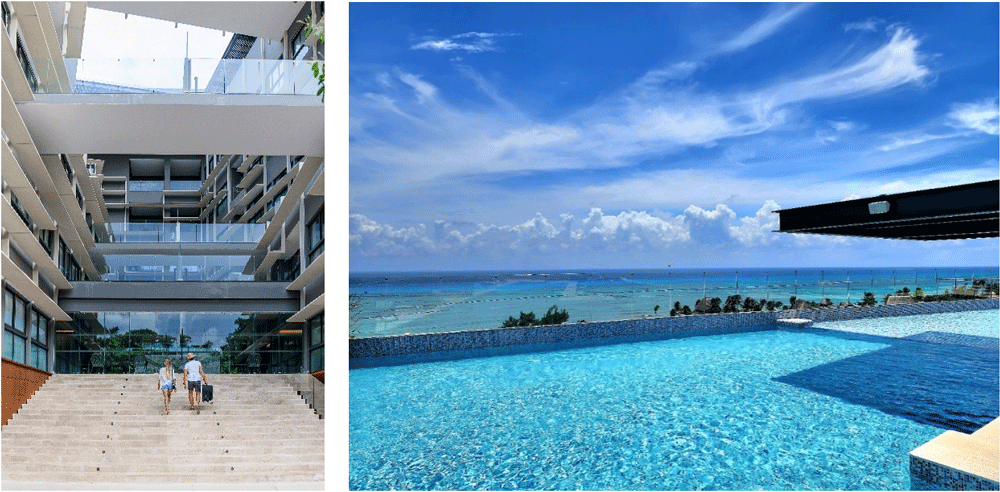

Once a sleepy seaside village, Playa has been transformed into a world-class beach destination. But development here has been different than Cancun. Playa is a real living, breathing city with a chic, cosmopolitan vibe.

This distinct atmosphere has made Playa a favorite of not just American visitors, but also Europeans, Latin Americans, and Mexicans from other parts of the country. It’s also a varied market, attracting snowbirds, part-time expats, digital nomads, extended vacationers, the work-from-home crowd…

As in Cabo, these folks aren’t looking for cheap or barebones. They want more amenities…and to be by the beach. And they’re willing to pay to get it. Trouble is, there just aren’t enough properties. And that situation isn’t changing any time soon.

Most desirable coastal land in and around Playa is taken up by resorts, gated communities, and the city itself. This creates moats, or barriers, to development and a scarcity of new, high-quality communities.

Even though prices are rising here, there’s no sign that demand in Playa will be met anytime soon, and this has created an incredible opportunity for real estate investors.

Supply-wise, it’s a similar tale farther south in Tulum.

The spectacular coastline of Tulum was first discovered decades ago by the hippies who drove through Mexico in their camper vans to frolic naked in the surf. Even when I first scouted it in 2004, it was tiny and undeveloped.

What a difference a few decades make…

As development moved south in recent decades, so too did the fashionistas, the Instagram influencers, yogis, and other wellness seekers. Every year they come, in droves…many of them happy to pay $1,000 a night to stay in a rustic palapa on the beach.

Today, Tulum is one of the world’s trendiest destinations, a favorite of models, socialites, celebrities and anyone who wants to catch a glimpse of them.

As in Playa, the challenge is a lack of developable land. North of Tulum lies a national park and the spectacular Maya ruins that draw millions of visitors each year. To the south is the vast 2,039-square-mile Sian Ka’an Biosphere. No building allowed. As for the beach, development is tightly restricted.

As Tulum grows, land for building is becoming more and more expensive. Prices are rising as demand continues to soar. Still, there is an incredible opportunity here for investors…

More visitors will come. The Mayan train is set to start running this year—a mega-project bringing tourists and renters from Cancun down to Tulum in huge numbers. A new Tulum airport just opened at the end of 2023 and has a reported capacity for 4 million passengers per year.

Already several U.S. airlines have announced they’ll begin offering flights to Tulum this year, including United Airlines, American Airlines, Delta and JetBlue. These services will link Tulum with Atlanta, Charlotte, Chicago, Dallas-Fort Worth, Los Angeles, Miami, New York City and other major U.S. cities.

As these infrastructure projects show, Tulum is reaching a whole new level. By owning best-in-class real estate in an amenity-rich community in Tulum, there’s still an opportunity to secure capital appreciation and impressive yields renting short and long term.

#3 (Tied): Rocha, Uruguay

Uruguay is wedged between Argentina to the west and Brazil to the east, with Paraguay to the north. This tiny country rarely makes the headlines, but it’s the wealthiest per capita in South America, according to the International Monetary Fund, and the most democratic, according to The Economist.

In recent decades, Uruguay has quietly become one of the best places in the region to invest in real estate thanks to its safety and security, government incentives, top-notch infrastructure, and business-oriented political leadership.

Uruguay’s luxury real estate market has long been centered on Punta del Este. Sometimes called the “Monaco of South America,” this beach resort city has for decades been the must-visit spot for the region’s jet-set, and it has the prices that come with it. Luxury beachfront homes here can cost anywhere from $2 million to $20 million.

But in recent years, Punta has become built up and maxed out. Today it draws huge crowds of everyday folks who want to rub shoulders with the rich and famous. In high season, the city’s population swells from 20,000 to around 400,000.

The “in crowd” are looking for alternatives. That’s why many are heading to Rocha…

Rocha is located about 1.5 hours’ east of Punta. Unspoiled nature is Rocha’s most important asset. It has the longest oceanfront coast in Uruguay. Inland, you’ll find nature reserves, lagoons, and forests. Yet despite its rural charm, Rocha still has all modern conveniences, small towns with nice restaurants and shops, and access to larger cities if you need it.

Recent infrastructure improvements have made getting to Rocha much easier. And that means those seeking a more low-key destination are flocking here.

I first heard about Rocha from my connections in Uruguay’s business community and even people with beach homes in Punta. Many of them told me they plan to build a beach home, or a second beach home, in Rocha. Those with a beach home already in Punta are building in Rocha to earn rental income. That explains why land along the immediate coast is already getting more expensive…especially if you’re looking to own a few acres of space.

As land prices rise, many are looking inland to the Sierras de Rocha. Just 28 miles from one of Rocha’s most famed beaches, this place is mostly virgin but already in the sight of many developers.

Even for a country as beautiful as Uruguay, the Sierras de Rocha offers a rare mix of attributes. There’s the stunning natural beauty of the mountains. It’s close to Rocha City, the laidback regional capital with a population of over 25,000, where you’ll find all the services and amenities you’ll need. And of course, you’ve easy access to the ocean. I think this is something special…

#3 (Tied): Estepona, Costa del Sol, Spain

The Costa del Sol is one of the world’s top tourist destinations. This strip of stunning coast in southern Spain has all the ingredients of a successful internationalized place.

The weather is amazing (it has 320 sunny days each year)…the beaches are stunning…and it boasts historic towns and cities, incredible locally produced food, world-class golf courses and marinas, and shopping and entertainment.

In the pre-financial crisis boom years, development came hard and heavy to the Costa del Sol. Huge condo blocks and pricey vacation homes sprang up. Now, many of the most popular locations immediately west of Malaga have been completely overdeveloped. There’s nowhere left to build.

Even the upmarket towns of Marbella and Puerto Banús have been impacted. So, vacationers with money are looking farther down the coast. They want to stay in more spacious surroundings…away from the tourist hordes.

Estepona is the next place in line to benefit as development pushes farther west. On my last scouting trip, I was blown away by how much this town, one of the prettiest on the entire Costa del Sol, had come to life.

It offers great restaurants, a beautiful old town, and a stunning beach. There’s a palm-lined waterfront boardwalk, botanical gardens, and a glass-domed orchidarium. And it has retained its traditional Spanish charm in a way that many other towns along this coast have not.

Prices in and around Estepona are rising fast, but it’s still possible to find good value here for those who move quickly.

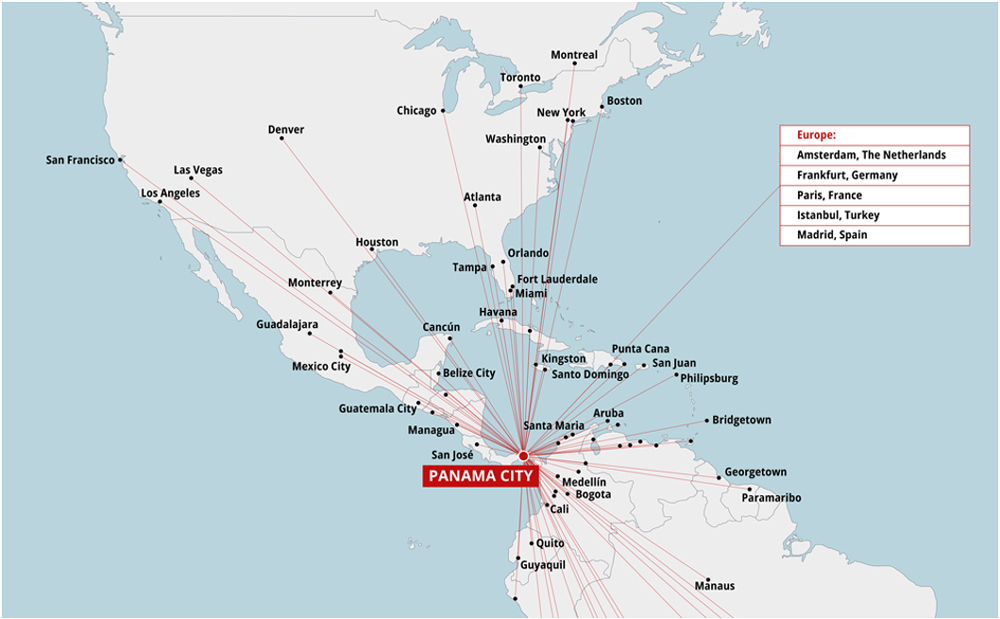

#6: Panama City

Only one major metropolis makes my list: Panama City. This is because the other global centers of trade and finance, such as London, New York, Hong Kong, and Singapore, don’t offer relative value or the potential for rapid capital appreciation.

Panama City is different…

A beacon of stability in an increasingly insecure world, Panama has made a great success of its strategic location for shipping and trade. It lies between North and South America with the Panama Canal connecting the Pacific and Atlantic oceans. Ever since the Canal was handed back to Panama in 1999, the country has boomed.

In the past decade or so, Panama has been one of the fastest-growing economies in the world. Along with the Canal, Panama’s business-friendly regulations have spawned big insurance, finance and legal industries. The country is home to numerous global banks and it’s the regional base of big multinationals like Dell, Nestle, and Procter & Gamble. The free-trade zone in Colón, at the Atlantic end of the Canal, is the second largest in the world.

At the center of the country’s booming economy is its fast-growing, ever-evolving capital: Panama City.

Walk the streets of Panama City today and you’ll pass trendy cafés…craft beer bars…Michelin-star restaurants…designer clothing boutiques…expansive shopping malls… All the hallmarks of an upwardly mobile population with money in their pockets.

Clusters of skyscrapers give the city a very modern skyline. And those very skyscrapers tell us one thing: land in Panama City is at a premium.

In fact, Panama City ticks all the boxes of a modern world city bar one thing—the astronomical real estate prices. Property prices here continue to offer excellent value relarive to other major world financial centers..but that’s unlikely to remain the case.

The city is increasingly attracting highly skilled professionals and entrepreneurs from around the world. The population is rising, as is demand for housing in the city center to form the city’s second wave of development. But there is one big hitch: a lack of developable land.

Panama City has a tiny land area. It’s hemmed in by the Pacific Ocean to the south. North of the city, there’s lots of protected forest around the Canal. There’s a very limited amount of land to build on. This moat on new development means that real estate in and around Panama City is locked in a long-term uptrend.

#7: Medellín, Colombia

Medellín is a place that’s been firmly on my radar since I first scouted it in 2011.

This city has undergone decades of transformation, yet it continues to be misunderstood by those who still associate it with the reputation for violence it garnered in the 1990s. The shadow of that period has long since left its streets, but it still lingers to some degree in its undervalued real estate market.

The city is located in a lush green valley, 5,000 feet above sea level and surrounded by verdant mountains. Known as “The City of Eternal Spring,” it’s a place where the weather is just about perfect year-round. Stroll down the city streets, and you’ll come across towering palm trees, rivers, and even frothy waterfalls.

With its chic cafés, theaters, museums, botanical parks, and open-air graffiti and mural galleries…Medellín regularly comes out top in many worldwide rankings of the best places in the world to visit, to retire, and even to conduct medical tourism.

For years, Medellín has been a hot spot for digital nomads…folks who can work from streetside cafes, while enjoying the stunning mountain backdrops. But since the pandemic, more remote workers have been coming than ever before. Increasingly, these are folks with money who rent by the month and will happily drop $1,500 for a one-bed condo.

While this trend has been taking hold in Medellín for some time, to a certain extent the local real estate market hasn’t reacted. You can still own two-bedroom condos in prime locations from $100,000…or a three-bedroom penthouse for just over $200,000.

But here’s the thing: despite the relative affordability of real estate in Medellín, there’s a limited supply of high-quality and well-managed condos for this new and growing group of wealthy renters.

Added to that, as Medellín grows and its profile continues to rise, it runs into another major problem. Hemmed in by mountains, it’s got a lack of developable land creating a barrier to expansion. These factors point to a multi-decade run ahead for best-in-class real estate in Medellín.

#8: Guanacaste, Costa Rica

Way back before Costa Rica’s tourist boom, the sunny northwestern province of Guanacaste was a sleepy region of cattle farms, empty beaches, and good surf breaks.

It fit the bill if you were looking for a little fun in the sun, but getting to this idyllic spot took some doing. The road from the capital city was in bad shape. It was a bumpy ride that took four or five hours. The alternative was to take a prop plane. Whichever option you took, it set you up for the lack of frills when you arrived.

But a savvy group of hotel and real estate developers could see the appeal of this endless-summer location. The Four Seasons pumped more than $200 million into carving out a top-quality golf course, rooms and suites, and hillside villas with private plunge pools. They needed tourists to fill their luxury rooms and pay their premium rates. A bumpy dirt track or a prop plane simply wouldn’t cut it…

The road from the capital San José was soon paved, and the airport at Liberia, the provincial capital just 30 minutes from the coast, was expanded and upgraded. In 2002, regular direct flights to the U.S. started. In 2003, Liberia airport saw 50,000 passenger arrivals. By 2022, the number had topped 1.4 million, with 2023 on track to exceed this high, according to the most recent data. Along the way, this region earned the nickname the Gold Coast.

In 2002, investment in residential development in Guanacaste began outstripping investment in tourism. Developers poured into the market, snapping up the best pieces of land. In the three years after those regular direct flights, prime beachfront land tripled in price.

Visit this part of Costa Rica today and you can stay in fancy hotels with 5-star service and 5-star amenities. The Four Seasons was joined by JW Marriott, Andaz, and the Westin. An investment group from Dubai is about to start construction on a super-luxury project. They claim it will be a 7-star resort.

In any number of towns across the region, you can play golf, relax in a spa, and dine in chic restaurants. These days, the area south and west of Liberia airport is home to not just high-rise condos but fancy gated communities.

In short, this is no longer a low-cost destination, whether you’re heading out to dinner or buying a home. But there is still potential for future development in Guanacaste, particularly along the coast near Liberia.

I expect the next phase of the region’s development will be focused there, and investors who get in on the ground floor could profit handsomely.

#9: Silver Coast, Portugal

The Silver Coast—or Costa de Prata—is a roughly 90-mile stretch of Portugal’s western Atlantic coast. Situated north of Lisbon and south of Porto, this region boasts pristine beaches, mountain views, excellent surfing, numerous traditional Portuguese villages, and some of Europe’s best golf courses. It’s sometimes referred to as “the Algarve of the north,” though that’s a somewhat unfair characterization.

The Algarve could be considered a notable omission from this list, given the massive popularity of Portugal’s southern coastal region. But the bottom line is that the Algarve has experienced astonishing growth in recent years.

I’m a frequent visitor to the Algarve and on all of my recent trips, I’ve been astounded by the mobs of tourists, the traffic, the lines… It would have been unimaginable a decade ago. If you got in before this massive growth, congratulations. Now, however, many of the best opportunities for capital appreciation can be found elsewhere.

As a result, many investors are looking to other parts of Portugal…and a major beneficiary of this trend has been the Silver Coast. The region is a softer, quieter, more wind-swept alternative to the bustling golden beaches down south.

I own real estate on the Silver Coast. A couple of years back, I bought a condo here in the golf and beach community of Praia D’El Rey. In that time, I’ve watched as property prices exploded. The price of my condo when I bought was €300,000. Last year, a local agent wanted to list it for €450,000…but I’m not selling.

Demand for rentals in this region, once inconsistent, has also gone from strength to strength as vacationers look for quieter escapes away from Lisbon and the Algarve.

A few years back, the Silver Coast would have finished much higher on this list, but frankly the relative value here is not what it once was. Property prices have risen dramatically in a short period and the room for capital appreciation has shrunk. That said, this is still a growth market.

I predict demand for rentals and second homes will continue to rise, so the right property at the right entry price here would prove a very sound investment.

#10: Montpellier, France

I love to spend time in “second cities.” These are not the initial port of call for first-time visitors to a country but can offer just as much to see and do, without the crowds. They also tend to be a lot cheaper. Montpellier on France’s southern Mediterranean coast is among the most attractive and exciting second cities you can visit.

Montpellier’s nickname in French is the “surdouée” (the gifted one), and it’s well deserving of it. You’ll find avant-garde architecture, art galleries, museums, and superb nightlife and dining. The city even has its own arc de triomphe. Then there’s the beach. It takes just 20 minutes or so on public transport to leave the compact city center and have your toes in the sand looking over the Mediterranean.

Montpellier is one of France’s fastest-growing cities. In the early 1960s it had a population of around 119,000. Today it’s in the region of 300,000.

The city’s airport has been adding new routes and a high-speed TGV train station means you can get to Paris in three-and-a-half hours. It’s also a huge center of third-level education. And given that it’s home to the oldest operating medical school in the world, it’s probably not surprising that biotech is big in Montpellier.

A few years ago, there was a window of opportunity to find an old and unloved property in the city center, and renovate it to rent out or relist, but those plays are now mostly gone (and were undoubtedly profitable for anyone who acted on them). Today, for ordinary two-bed apartments in Montpellier, you’re typically looking at a price of at least €250,000. Within the city center, historic apartments go for €500,000 plus. So, this destination is by no means cheap.

But my instinct is that Montpellier’s status will continue to rise. This is a cosmopolitan city with a lot to offer. There is still space for tourism growth. And a thriving startup scene along with a young, well-educated population gives it a strong economic underpinning.

Combine that with 300 days of Mediterranean sunshine…some stunning white-sand-dune beaches nearby…and the enviable easy-going lifestyle, and you have a recipe for a great place to live and long-term strength in the real estate market.

The Best Way to Get in on

Incredible Real Estate Deals

For years after I began investing in overseas real estate, I searched for a group of like-minded folks…a club for people who, like me, understand that there’s always opportunity somewhere, when you look everywhere.

I knew there had to be many others who would recognize a great real estate deal wherever it was in the world and act decisively. I searched in vain. For there was no such group. So in 2008, I founded my own…

I called it Real Estate Trend Alert.

Today our RETA club is bigger than I ever imagined it would be, and it’s become a unique deal machine.

Using RETA’s group buying power, I’m able to negotiate exclusive, off-market deals for our members. For a deal to cut my muster, I have to see clear potential for us to double our money invested in five years. I particularly love deals that offer us rapid capital appreciation and enormous income potential should we chose to rent upon delivery.

This process all starts with my team and I identifying up-and-coming markets and major transformations with potential. For months or even years before I send details of a members-only deal, I’ve been researching…putting boots on the ground…and meeting high-level contacts in the destinations where I feel there could be a hot opportunity.

Then, once I’m confident a major transformation is underway, I use RETA’s group-buying power to negotiate a deal with a best-in-class developer.

Because of the combined group-buying power of all Real Estate Trend Alert members, I’m able to negotiate some serious discounts on retail pricing. An off-market, RETA-only deal must see us paying much less than anyone else, which means we’re locking in significant gains from the get-go.

Why do these developers agree to offer us the unbeatable pricing they do?

It’s a simple win-win for each side. The developer gets quick and discreet sales from our group…allowing him to go to the local market with sales under his belt and the confidence to charge higher retail prices (i.e. the price everyone else pays)…and we get a deal at a price no one else can even dream of.

To give you just a brief snapshot of some of our RETA-only deals…

- $388,844 More in Cabo—I first scouted Cabo in 2014 and very quickly realized it was about to hit a whole new level. In the years since, I’ve brought a run of incredible deals to RETA members there.Our first RETA deal in Cabo was in 2015 in the 5-star Quivira resort. Our RETA-only price on a two-bed, two-bath ocean-view condo in the best-in-class Copala community was $336,156. I bought one alongside RETA members. Last year, an identical condo to mine two floors above me listed for $725,000—an uplift of $388,844.More recently, in May 2022, we had a deal in a community called Monte Rocella. I bought two condos alongside RETA members in this deal. A condo that RETA members could buy for $272,600 later listed for $485,000. That’s $212,400 more.

- Boost of $309,018 in Playa del Carmen—Playa is an hour south of Cancun along the Riviera Maya, Mexico’s Caribbean coast. As Cancun boomed in recent decades, progressed rolled south to Playa, transforming this once-sleepy fishing village into a world-class tourism destination.I first scouted Playa way back in 2004 and in recent years, I’ve brought RETA members a host of killer deals here. For instance, in 2021, RETA members had the chance to buy two-bed condos in a community called Singular Dream from $265,304. In early 2024, a two-bed condo in Singular Dream was listing for $574,322—that’s an uplift of $309,018.

- €300,000 Gain in Portugal—Portugal’s southern Algarve region is a place of rich culture, great food, soaring cliffs, white-washed villages, stunning beaches, and 300 days of sunshine a year…all of which has made it one of the most popular beach destinations in Europe.In August 2019, one RETA member bought a penthouse in a community in the Algarve that I recommended for €495,000. Just over three years later, in October 2022, she sold for €795,000. That’s a gain of €300,000.

- $222,000 Gain on Mexico’s Riviera Maya—In 2019, I brought RETA members the chance to own luxury two-bedroom condos in a community called Santamar on the Riviera Maya, Mexico’s Caribbean coast, from just $174,800. A two-bedroom mezzanine-level condo with Caribbean views bought for $178,000, later sold for $400,000—a $222,000 gain.

- Gain of €223,000 in Spain—In 2020, we had our opportunity at Casares Costa in Spain’s Costa del Sol. A RETA member bought a luxury condo here for €327,000. It was later sold for €550,000.

Nobody I know does the kind of travel and firsthand research we do.

Nobody I know has our contacts and ability to negotiate such incredible, off-market deals for members.

And I know has RETA’s track record of being ahead as destinations experience major transformations.

While you’ll get lots of travel and research reports in your Overseas Dream Home…the best deals…the off-market, members-only deals are only ever found in RETA.