Each year, as spring rolls in, I pack my bags, lock my front door, and leave my condo in Cabo San Lucas behind.

It’s a liberating feeling. I like to spend my winters in Cabo. But once the weather picks up, it’s time hit the road and head to Europe where I’m based until late fall.

The ability to just pick up and go is priceless to me. And it’s made all the easier when I know that, if I choose, I can hand the keys over to a property manager, who can deliver a $1,750 check to my account each month.

The truth is almost anyone can own a profitable home overseas. With the right real estate plays and a lot less money than you might think, you could actually own several…travel among them, rent them for a good income when you’re not there, and the day you want to sell, you could lock in a meaty profit.

This international lifestyle and the ability to profit from destinations with a decade plus of upward growth is the reason I love overseas real estate.

You just can’t find that combination in North America. Wearing an investor hat, it’s difficult to see much sustainable upside there.

Most U.S. and Canadian markets are highly leveraged and expensive relative to incomes, very susceptible to interest rates rising or employment falling. I’ve watched over the last two or three years as “little guy” property investment and speculation has come back in vogue. News articles and hundreds of blogs cover investing in Atlanta or Austin. Television shows feature baristas or graphic designers turned house flippers.

For me, that kind of investment play is way more stress than I need. Instead of tight profit margins and a lot of sweat equity, I prefer to look for markets with huge upside and lower risk. Markets where even in times of global crisis, we can still do well.

I also like to buy in destinations where owning real estate doesn’t feel like a major liability. When I lock my door in Cabo each spring, I know that my condo’s holding costs aren’t eating into my assets while I’m not there.

I pay just about $300 in taxes and HOA (homeowners’) fees on my condo a year. A similar property I found in California had holding costs of $2,320 a month. We’re talking magnitudes more. And that’s not even including insurance or utilities…or mortgage payments for that matter. That’s for a home that you own outright.

And, quite honestly, the holding costs of my condo in Cabo are quite a bit higher than many opportunities I’ve uncovered…

First time investors frequently overlook the importance of holding costs. But if you fail to consider what owning a particular property will set you back each month, it could eat into your returns.

Holding costs (or carry costs) are any recurring expenses you have to pay on a property. Typically, you’re talking condo fees or Homeowners’ Association (HOA) fees for homes in private communities, property tax, insurance, and utilities. You might also include interest on a loan in your holding costs calculation.

These costs can vary significantly depending on location of the property, its age, your loan type, and whether you’re a long- or short-term investor.

For instance, if you’re a short-term investor (such as a house flipper), you might have to get unoccupied property insurance. Or you might have a loan with a high interest rate. And if a project runs on longer than expected, those holding costs could significantly reduce your profit margin.

Likewise, if you’re investing long-term for rental cash flow, you need to be aware of management costs and anything else that can affect your net income.

But when it comes to holding costs, there is no single factor as important as location. Where you buy—in which jurisdiction or country—can be the difference between paying a few hundred dollars a year or multiple thousand dollars a month. It affects the property tax you pay, the cost of your HOA fees, your insurance costs, utilities, and more.

For second-home buyers, this is crucial. After all, a second home is something that’s supposed to be there to enjoy, not a cash drain that keeps you awake at night.

Like I say, when I lock my door in Cabo each spring, I don’t have to worry because I’ve already accounted for the low holding costs. But if I was an owner in California or Florida, it might be a very different story.

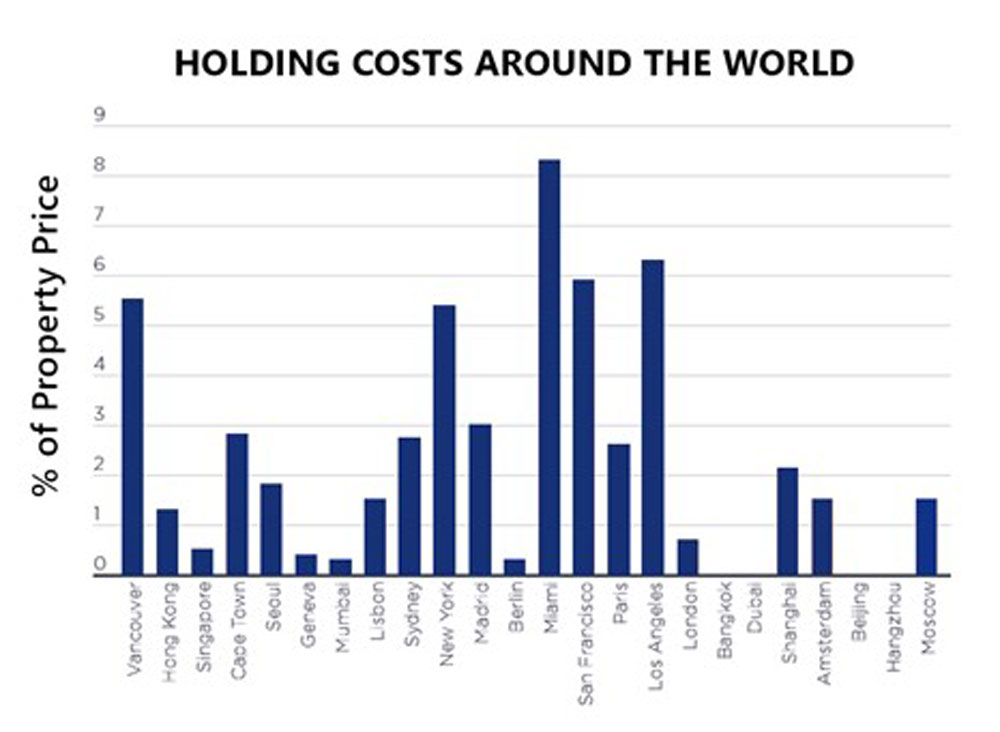

A recent survey by Savills research found that the holding costs of luxury property in major North American cities exceed those in the rest of the world by a long shot.

In the U.S., you can expect to pay higher property taxes, higher HOA fees, and steeper insurance premiums.

For example, in Miami, an average two-bedroom condo close to the waterfront could cost you anywhere from $600 to well over $1,000 a month in HOA fees alone. Property taxes in Florida are a little below the national average but still come to a state average of 0.94% of property value. So, even on a $250,000 home, you’ll pay $2,350 per year.

And in a hurricane prone state, you can expect a hefty insurance premium. I’ve seen reports of homeowners paying upward of $16,000 a year in places like Key West.

My point is this: These are all costs you can minimize when you buy in the right real estate markets.

In the right destination overseas, you’ll not only find real estate that you can buy for far less than the cost of similar homes in the U.S.—a property that offers you the lifestyle you want, and can make you money too—but you also won’t be paying through the nose to maintain it.

Take a home in Portugal worth about €200,000. For that, your property taxes would be just about €400 per year. Your home insurance would typically be only €250 a year. And your HOA fees would amount to just €300 to €400 a year—or €800 a year with a pool.

That’s just €950 to €1,450 a year, total.

If you decide to rent, you can make that back in a week in a popular destination like the Algarve. After that, the property is yours to enjoy as you please. You don’t need to worry about impending bills or leaving it vacant for a week or two while you travel.

And that, ultimately, is what makes a home an asset…

Let’s take a deeper dive into holding costs in Europe…

Holding Costs Associated With European Real Estate

I’ve gone sale agreed on a home on Portugal’s Silver Coast.

The condo I’ve locked down is as close to true beachfront as you can get in Portugal. It’s on a stunning stretch of Atlantic coast. A contender with anything you’ll find in Malibu, Pebble Beach, Dubai, or the Bahamas.

But I’m paying just a fraction of what I’d pay for a similar property in any of those places.

In fact, when I first ran the numbers, calculating my costs, I thought I’d made a mistake, dropped a zero somewhere, or misplaced a decimal point.

After double-checking that it was all correct, I came to an incredible realization…

Buying a beachfront home in Portugal is cheaper than simply owning and maintaining one in the U.S.

That might sound like an exaggeration, but let’s look at the numbers.

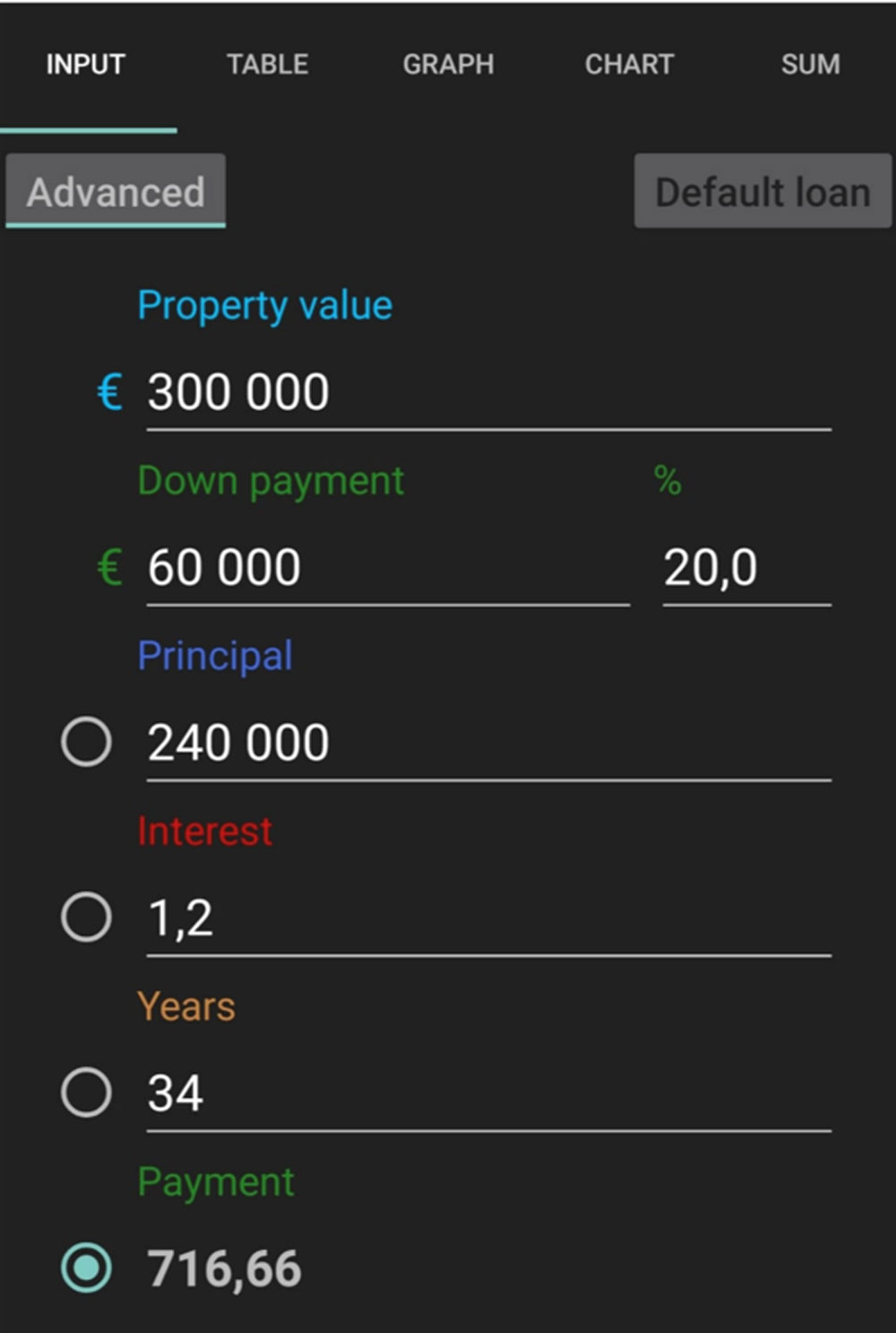

On the calculator above, you can see an approximation of what my monthly mortgage payment will amount to. In Portugal right now you can borrow at incredibly low rates. So, on a €300,000 property, I’ll only be paying €716.66.

My property tax will be about €500 a year. And including condo fees, insurance, utilities, and all other holding costs—along with my mortgage—I’ll be all in for under €1,000 ($1,172) a month.

Now, take an ordinary two-bedroom condo I found near the beach in Miami. Its HOA (homeowners association) fees are $636 a month. The tax payment last year, with a lower valuation than the list price, was $9,135.

With a mortgage on this Miami condo, you’re looking at $3,635 a month in hold costs. That’s for the mortgage, property tax, HOA fees and insurance. It does not include utilities.

And that’s more than three times what it will cost me for my true beachfront condo on one of Europe’s most spectacular coastlines. In fact, what I pay for holding costs plus my mortgage in Portugal wouldn’t even cover the holding costs alone on this property.

As I said earlier, it’s critical to consider your holding costs wherever you decide to buy.

What will you pay in HOA or condo fees, property tax, insurance, utilities, or any other regular expense that crops up?

These are the costs that many inexperienced homebuyers overlook when they’re searching for a property. They focus on the marquee figure, the initial purchase price, without considering what that property will do to their monthly bank statement once they own it.

By buying in a place with low holding costs, you’re locking in overlooked value. You’re not holding an asset that hemorrhages money. And you’re not tied to your home in the way you would be when it’s costing you well over $1,000 a month just to keep the lights on. You can lock up and leave when you want. And if you’re renting it out, you cover your costs and start turning a profit a lot faster.

That was a big part of my decision process when I put an offer on the condo on Portugal’s Silver Coast.

The Silver Coast doesn’t have the type of income potential that would make it a strategy for making money from your overseas home. It has a very short tourist season and nowhere close to as many visitors and international buyers as the Algarve. Even true oceanfront condos here will only gross €12,000 to €15,000 a year in short-term rental.

But given that the holding costs are so low, that’s plenty for my purposes. My plan is to only use the condo for a couple of months a year, at most—and that won’t be in high season. So, I can rent it out for July and August and make enough to cover holding costs and a good chunk of the mortgage too.

In Europe, one of the biggest expenses is generally the initial closing costs. For example, in Portugal, on a property valued at €140,000, you’d expect to pay about 5% in closing costs—transfer tax, notary fees, real estate registrar fees, attorney fees.

However, after that, your ongoing holding costs are nominal.

It’s a similar scenario in Spain. You’re initial buying costs can be high. Expect to pay about 10.5% in costs for a pre-owned property and about 13.5% for a new build.

Once you’ve settled your purchase costs, your holding costs will be relatively low.

In Portugal, Spain, Italy, France, and other European countries on my beat, you can generally rely on low holding costs. If you’re buying for investment, this means you’re pocketing more net income at the end of the month.

If you’re buying a home for yourself, it’s also a massive benefit. It offers you greater freedom to live the lifestyle you want without incurring extra costs. And with the right property in Europe that can be an extremely attractive proposition.

Take this home that we have shared on our Your Cheap Dream Home Instagram account recently in Montegiorgio in central Italy that’s listed for just €75,000 (approx. $88,500).

The main property tax in Italy is the IMU property tax, which is calculated on a property’s declared value. Set by local municipalities, it’s complicated to calculate, but generally the rate varies from 0.4% to 0.7%. Figure paying about €300 a year on insurance. That makes your recurring fees incredibly low. You could even hire a property manager to do the paperwork and organize your payments for you. It would cost about €150.

Pair that with an Italian mortgage at an interest rate of under 2% and you’re talking very low monthly costs. I figure just over €300.

Sure, this property would need a lot of work to renovate and revive. But with such low outgoing costs, your budget can stretch a lot further.